Craig

“Faketoshi” Wright and Bitcoin SV is running a variant of the Nigerian

scam. Nigerian scams work because “by sending an email that repels all

but the most gullible, the scammer gets the most promising marks to

self-select, and tilts the true to false positive ratio in his favor.”

[Cormac Herley, “Why do Nigerian Scammers Say They are From Nigeria”].

In other words, Nigerian scams work because it is a hyper efficient

idiot finder. Only an idiot would engage with such a preposterous claim

regarding a Nigerian prince. Most people will just ignore it, and this

is good for the scammer because the scammer does not have to waste time

engaging people with brains. Imagine if you were a scammer and you sent

out a million emails. You don’t want to waste time corresponding with

hundreds of people with normal intelligence, you want to find the

stupidest of the bunch.

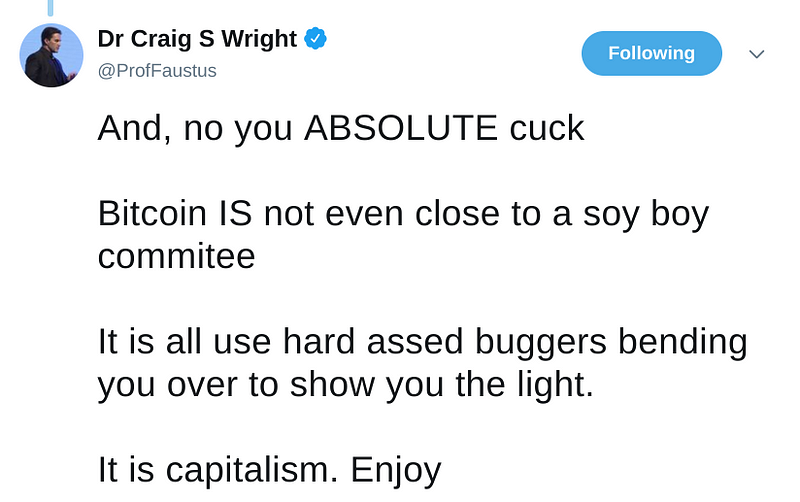

Craig

Wright is basically a Nigerian prince (or as per the title of this

article, a Nigerian Nakamoto). Only an idiot will actually believe that

someone like Craig is Satoshi. He is in fact the exact opposite of

Satoshi. A patent trolling, plagiarizer who uses 4chan insults and technobabble.

|

| So called creator of Bitcoin rallying against soy boy committees |

It

would be a mistake however to believe that Faketoshi himself is an

idiot, he is not. He is merely playing a character that attracts

gullible idiots. Craig was smart to position himself into the Bitcoin

Cash crowd because he correctly deduced that they had the right

combination of gullibility and liquidity. He saw that they were eating

up ridiculous conspiracy theories that revolved around Blockstream. It

would not be that hard to convince them that he was Satoshi, especially

if he was on their side of the fight against Bitcoin. I suspect that

people in leadership position within Bitcoin Cash like Roger Ver were

smart enough to know that Craig was a fraud. However, they were morally

bankrupt enough and too short sighted to reject him because they thought

that he was on their side. I’m surprised that Ver has so far received

almost no backlash from the ABC camp from this ordeal. He 100% enabled

the SV camp from gaining credibility within Bitcoin Cash. If you are a

Bitcoin Cash conspiracy theorist who believe everyone is a Blockstream

plant, you have to wonder whether Roger Ver himself isn’t a Blockstream

plant.

|

| Roger Ver sharing a drink with SV |

Once

Craig gained credibility within Bitcoin Cash, the next step was to

splinter off the chain into Bitcoin SV. This step is equivalent to the

phase where the Nigerian prince gives you a bank account number to wire

the money to. With the financial backing of billionaire and online

casino mogul Calvin Ayre, Bitcoin SV was created. Before and during the

chain split, SV made a lot of noise regarding a hashwar where they

threatened to 51% attack the ABC chain. Many people

took the bait and believed that there would only be one chain that

would remain after the split. However, this was all just a marketing

ploy to give legitimacy to SV.

SV

would gain nothing and probably lose by engaging in a hashwar against

ABC which has the backing of mining giant Bitmain. What SV wanted was

for the stupidest people within Bitcoin Cash to self select themselves

onto a chain where they have 100% control. The next step is obvious.

Once they have total control on the chain containing a bunch of stupid

people that are members of the cult of Faketoshi, they are free to do

whatever they want. Faketoshi has already hinted that they were going to

be stealing burned coins,

by changing the code to interpret them as miner rewards. There are also

other creative ways to make money, especially if you control both the

software development and mining on the chain. Bitmain showed that such a

scheme was possible with their implementation of ASICBoost.

I would also not be surprised if they decided to implement some

inflationary scheme that enriches their own wallets at some point in the

future.

I

think the mastermind behind this idea can be traced to Calvin Ayre, who

made his money running online casinos. He sees the blockchain as a

poker table. And there’s two sure fire ways of making money in poker and

that is a) to make sure you are the house and b) that you are always

playing against terrible poker players. POW mining is like a game of

chance after all. Being able to fully control the software development

enables you to be the “house” and set the rules of the game. Kicking out

Bitmain into their own chain also allows them to be the biggest player

on the table. Now the only task remaining is to steadily dump the newly

minted SV coins. I suspect that SV will be very good at doing this

because the crypto market is mostly just a large unregulated online

market for people to gamble their excess money away. Calvin Ayre is an

expert in that market, and Faketoshi gave him the best customers.