|

| The County Election, George Caleb Bingham 1856 |

Let’s say there is a person who has never experienced or learned how a democratic process works. He could be a North Korean subject, or perhaps a time traveling Feudal era peasant. If we explain to this person what the American government looked like in 2017 -2019, when the Republican party took control of the executive and legislative branch (or 2008–2010 when Democrats took control), he may wrongly conclude that a single party controls the country, and that the American government is autocratic. This conclusion is of course wrong. In a functioning democratic process, a single party can take majority control but the people will vote them out if they don’t like how that party is governing.

This hypothetical person is making an observation regarding the configuration of a democratic government in a single slice of time, and makes the wrong conclusion because he does not understand the political process that created this configuration. A person who only understands tyranny will have a hard time comprehending a political process that is able to remove people in power through fair elections where each citizen has a singular vote.

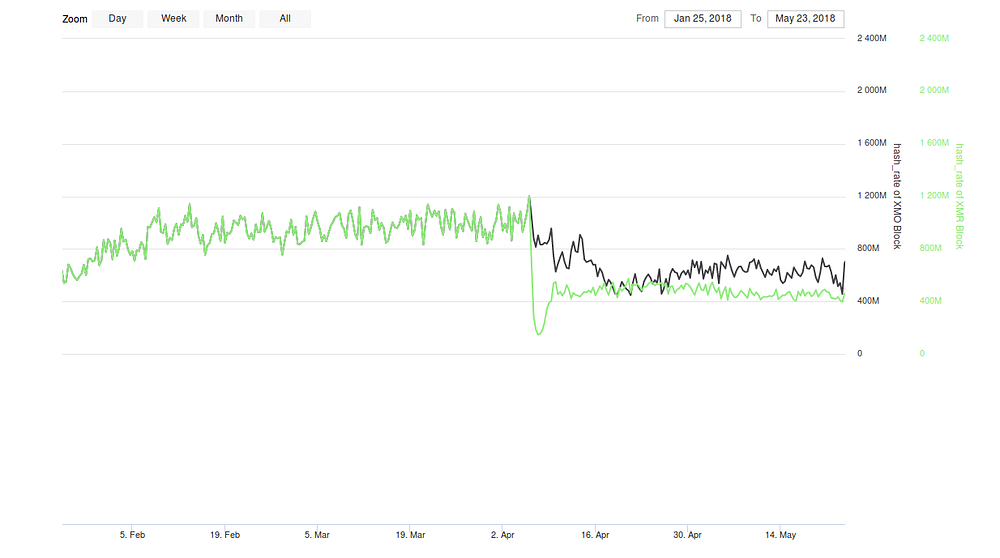

Similarly, in the cryptocurrency community and in casual observers of Bitcoin, there are people who claim that Bitcoin is controlled by China because much of the current mining appears to be coming from China. While estimates are unreliable due to the anonymous nature of mining, industry insiders and studies places the percentage of mining from China to be at around 65%.

Referencing these estimates, Ripple CEO Brad Garlinghouse stated: “Bitcoin is really controlled by China. There are four miners in China that control over 50 percent of Bitcoin. How do we know that China won’t intervene?”. Garlinghouse is much like the confused North Korean subject who does not understand Democracy. As the CEO of Ripple, he only understands cryptocurrencies which are ruled through singular entities. Therefore, he has a hard time understanding that there is a systematic process in Bitcoin that allows for miners to be removed from power if they are deemed to be unworthy. Since he does not understand this process, he can merely describe the state of affairs in a single slice of time.

This willful ignorance is of course part of Ripple’s strategic effort to appeal to US based regulators. In response to the recent SEC lawsuit against them, Ripple responded by saying that this lawsuit will cede innovations in cryptocurrencies to China since “Bitcoin and Ethereum blockchains are highly susceptible to Chinese control because both are subject to simple majority rule, whereas the XRPL prevents comparable centralization.” The obvious subtext here is that Ripple is winking to the regulators saying: “Hey don’t sue us because we control XRP and if you take it easy on us, we’ll let you control it and not China”.

Although many like Garlinghouse are confused by it, Bitcoin’s systematic process of mining has been made clear from the beginning. Satoshi stated in his white paper that Bitcoin is a consensus mechanism of “one-CPU-one-vote”. Although we now have special machines custom built to perform mining (ASIC’s), the spirit of the statement remains the same. If you are willing to expend resources to mine, you are given votes proportional to the resource you’ve expended. One hash equals one vote.

Since Bitcoin does not know or care who is doing the mining, a singular entity is free to accumulate the majority of the hashrate of the Bitcoin network. But this is not a problem for Bitcoin, the same as how it is not a problem for Democracy if a political party gains majority control. At the inception of the Bitcoin network, Satoshi owned 100% of the hashrate for quite some time. There were also times in the past when a mining pool was verified to have more than 51% of the hashrate. The caveat to this is that if people do not vote out misbehaving or tyrannical entities, then Bitcoin cannot function. Democracy works in the same way through an informed and motivated electorate. Critics of Bitcoin are correct to say that China could in the future forcibly mobilize the miners in their country to 51% attack Bitcoin. But critics would be dead wrong if they believe that proponents of Bitcoin will do nothing in response.

While mining farms already operating outside of China will play a huge role to counter such attacks, individuals can make a difference simply by running ASIC’s from their homes. Right now, you can buy an Antminer S9 for about 30$ and run it with about a microwave’s worth of power consumption. With the current network hashrate of about 130 million TH/s, a single S9 (14 TH/s) buys you roughly 1 vote out of 10 million on the Bitcoin network (consider that a US citizenship buys you 1 vote out of 250 million). Such mining can be done by anyone in the world, and individual can expand their operation to as many ASIC’s as they are willing to spend money on. Furthermore, the availability of capable ASIC miners will increase in the future as newer generations of ASIC’s hit the physical limits of Moore’s law and their advantage against older ASIC’s become diminished.

If one does not have access to facilities or the power required to mine, they can fund friendly miners with Bitcoin. This can be done by either utilizing Bitcoin transaction fees, or by directly sending a transaction to the miner. By simply initiating transactions that would get accepted on the friendly chain (but not the chain of the 51% attacker), Bitcoin users can fund and incentivize friendly miners to counter the 51% attack.

I would also not underestimate the Bitcoin miners in China. Many of them will refuse to comply if China orders them to work against Bitcoin, as the destruction of Bitcoin also means that their livelihood is destroyed. The competitive nature of mining guarantees that miners are mostly people who believe in the long term value of Bitcoin. Profit seeking miners who intend to convert their gains into fiat will generally get pushed out by the believers who are willing to take short term fiat losses. Mustafa Yilham, VP at a large Chinese Bitcoin mining firm, states that “from our experience in China, most large scale miners are very firm believers in Bitcoin”.

In summary, China does not control Bitcoin. They are merely voting participants in the global Bitcoin network, the same as everybody else. The beauty of the Bitcoin network is that it does not discriminate against anyone from participating in the formation of consensus. If you take this aspect away, you end up with XRP, or whatever abomination of a currency that Facebook is creating. Does China have a chance to maliciously control Bitcoin? Yes they certainly do. I think it would be irresponsible to say that China didn’t have a chance. Such predictions can create complacency, much like how incorrect polling numbers can create complacency in the electorate. But I’m certainly not betting on that to happen. And like many others, I will be vigilant and ready to make sure that never happens because that is how Bitcoin truly works.