As I write this, Bitcoin just ripped through 19,000 $ and hit all time highs. As a holder of Bitcoin, part of me is euphoric, the other part of me is a bit melancholy. If this bull market is going to play out, this would be my third bull/bear cycle in Bitcoin, and this feeling of melancholy is a bit new for me.

Every Bitcoin bull market has a story. During my first in 2013, I was just in amazement that this Bitcoin thing existed at all. I really didn’t know much about it other than that it was this magic internet money. The 2013 cycle was a story about the rise and fall of the Mt. Gox Bitcoin exchange, which I nearly lost money on while trying to arbitrage it. At my second bull market in 2017, the story was the rise of blockchain and distributed software. I felt validated that I was right about the potential of Bitcoin. I was also stupefied by the number of altcoins and Initial coin offerings (ICO’s) that Bitcoin managed to catapult into the stratosphere, some of them which I’ve helped develop.

This incoming bull market feels different, because the story isn’t about Bitcoin, blockchain, or cryptocurrencies at all. The story is not about some niche things that only a bunch of nerds care about, where I could join in and make some money. The story is one that affects everyone in the world, and we are living it as we speak. As Bitcoin rockets upwards, COVID is raging around the world, governments have failed to contain it and destroyed their economies, central banks have unleashed the printing press, institutions are failing, and people are suffering.

There’s a scene in the movie Big Short where the two young traders from Brownfield fund are dancing and celebrating the deal of their lifetime. They just managed to short the CDO’s which will shortly blow up in the bank’s faces in the 2008 financial crisis. The veteran trader who helps them out, played by Brad Pitt, angrily tells them to stop dancing. He tells them this:

“Do you have any idea what you just did? You just bet against the American Economy. Which means, if we’re right, people lose homes, people lose jobs. people lose retirement savings, people lose pensions.”

Like the young traders in the movie, I didn’t really understand or comprehend the gravitas of what I was buying in my first two bull cycles. It was just magic internet money. But now I do, and the story of this bull market makes it clear. If you are buying Bitcoin, you are going short. Most shorts are of no consequence. If you are right, maybe a company goes bankrupt or the price of an financial instrument drops by a few percentage points. But if you are making a “Big Short”, you are betting against a foundational economic reality. If you are right, the pain will be so real and prevalent that it will affect you even though you are theoretically on the other side of the trade.

Buying Bitcoin is a short against the foundation of the world’s economic system. It is simply impossible to be 100% on the other side of this trade because you exist in it. It’d be like trying to short the Titanic while you are on the Titanic. As Bitcoin rises, so will global inequality and social unrest. Currencies will fail and financial systems will crumble. People will lose homes, jobs, savings, pensions, and their lives. At the same time, governments will tighten their financial controls, increase censorship, and violently try to prop up their failing regimes.

Up until about 2017, I used to believe that Bitcoin was mostly only useful in failed countries with hyperinflation like Venezuela, and that people like myself who live in first world countries didn’t really need it. I thought of Bitcoin as a short against these regimes, and these regimes only. However, as I learned more about economics and how central banks worked, I realized that this wasn’t the case. In 2020 much of what I learned in theory is being played out in reality.

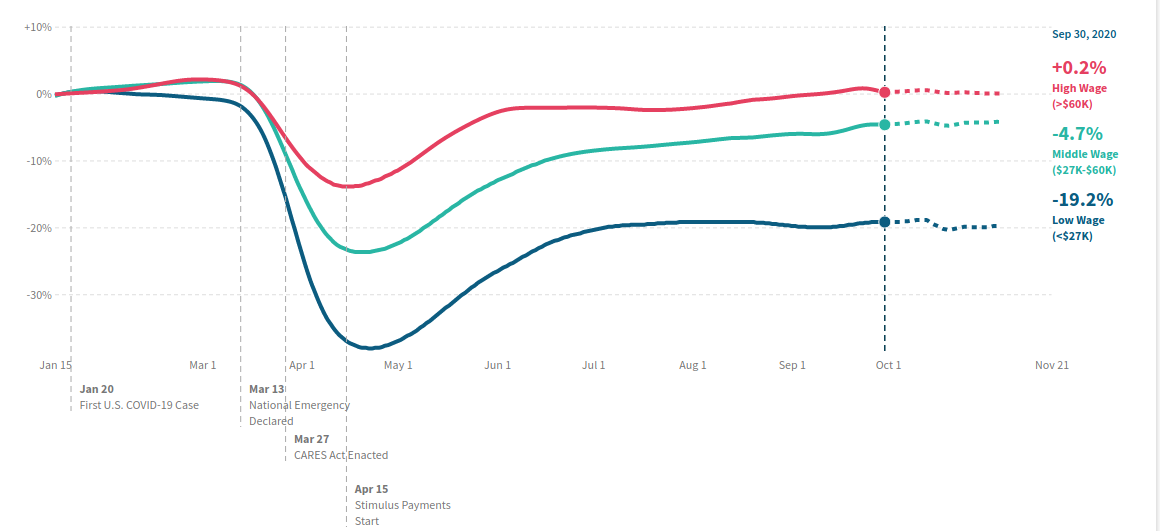

There are really two stories to this bull market. The first story is one of historic unemployment borne by the lower class. You can see this clearly in the chart below where the unemployment rate for low wage workers have exploded, while high wage workers are nearly back to previous levels.

This story is also that of people waiting in long lines at the food bank, and of people looting. Of small businesses getting crushed. It’s also a story of people looking for answers to their economic woes in the wrong places. The left seeks out Marxism, and the right seeks out Fascism like it’s the 1920's.

The second story is that of ballooning asset prices, despite the cratering of economic activity caused by a global pandemic. The Federal Reserve has increased its balance sheet by more than 3 trillion dollars by going on a massive buying spree for bonds, corporate debt, and mortgage backed securities. Stock prices is at all time highs relative to GDP and the Dow just hit 30k for the first time ever. The real estate market is booming. Absurd business operations have received millions in federal loans. The beneficiary of all this is of course the upper class, who owns most of such assets. The people that should have the largest safety nets in an economic crisis, are getting the most “aid”, if you can even call it that.

The mainstream media and politicians have described the current situation in the US as a K- Shaped recovery. Austrian economists describe this as the Cantillon effect, a process where those closest to the money spigot gain the most benefit from all the money being printed. Both of these descriptions are very polite ways to describe the systematic pillaging and redistribution of wealth to the upper class. As one Twitter user describes it, “K-shaped recovery” is a phrase assholes use with a straight face instead of “I got mine, suckers.”

The most insidious part of this story is that the average person getting screwed has no idea what is happening to them. They can instinctively feel that they are getting a bad deal, but they don’t know who or what is screwing them over. The right will blame immigrants, china, and liberals. The left will blame racists, rich people, and conservatives. Watching this play out is like playing the popular multiplayer game “Among Us” where you try to identify the imposter (or “sus”) among your space ship crew. You know exactly who the imposter is because you watched him kill your crewmates, but the other surviving crewmates don’t believe you.

|

| Fed is very sus |

Being right is not enough. Bitcoin can go to a billion dollars and you can still lose. And in this bull market, the stakes have been raised. It’s no longer about insignificant bullshit like Mt. Gox, blockchain technology, or ICO’s that has no relevance to the rest of the world. This bull market is about the ungodly amount of money that has been stolen and injected into the world economy that is trickling its way into Bitcoin. People are finding it impossible to go long on a market that has been rigged by the central banks and the ruling class. Even big name macro investors in traditional finance like Stanley Druckenmiller and Paul Tudor Jones agree with this sentiment on a logical level. For many who have held onto their Bitcoin for a long time, they agree on a moral level.

If you are a Bitcoin holders now, congratulate yourself for being here. But before getting too giddy, we have to remember the story of this bull market. Bitcoin is no longer some niche thing in its own little world. The world of Bitcoin is colliding and merging with the real world as we speak. In this Bitcoin bull market, and in many more cycles to come, the story will be about failed economic systems all over the world meeting its inevitable demise. The pain is coming regardless of whether you hold Bitcoin or not. I’m going to be humble and ready, but I’m not in the mood for much dancing.

No comments:

Post a Comment